|

In a previous post, I explained why insurance has become so complicated. The key to eliminating these complexities is to engage the services of an experienced independent insurance agent. Here's why:

You're not by yourself if you feel overwhelmed when making decisions about your insurance coverage.

Why is insurance so complicated, and how do you navigate through coverage options to ensure you choose what's best for you? Read on for answers to these important questions. I commonly review policies with limits that are alarmingly low and leave the client much too open to financial liability.

This is one of the common mistakes people make when they self-select insurance coverage online. Here's a prime example: Have you ever let someone borrow your vehicle and then wondered who would be responsible if that person had an at-fault accident while driving it?

What about your child who no longer lives at home? What about your roommate? These are just a few examples each involving different circumstances and which may impact whether they should be listed on your auto insurance policy. Generally speaking: What does the Russian invasion of Ukraine have to do with your auto insurance rates?

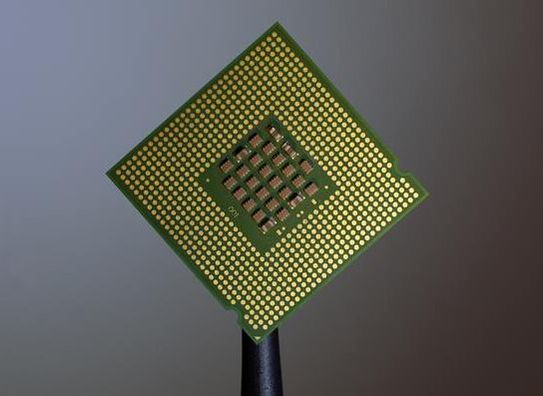

Ukraine is a main supplier of neon, and Russia is a key supplier of palladium - both components used in the production of semi-conductors and may directly influence chip shortages. But that's not the only factor causing a rise in auto insurance premiums. Here's a sampling of other direct influences on auto insurance costs: Do you have a recreational boat?

As recreational boating season ends for the year and you prepare to store your boat, there are several things you need to consider insurance-wise:

Recreational boats are a large financial investment, so protect this valuable asset. Call me at 706-726-1446 to make sure your boat is adequately covered, not only during peak use season but also during storage periods. With the temps feeling like fall, it's almost time to fire up your wood-burning fireplace for the first time this season.

Do you remember when it was last inspected and cleaned? If chimneys aren't properly maintained, they build up creosote that can catch on fire and can escalate into an all-out house fire very quickly. Chimney fires are largely preventable with ... Is it worth it to have a cell phone warranty or insurance?

If you're prone to dropping your phone, losing it, or consider it essential to your work role, this may not even be a question, but rather how to decipher your options. Factors to consider: Living in high relative humidity climates like we have in Georgia and South Carolina increases the possibility of mold developing in our homes.

Anytime thick, humid air interacts with surfaces that are cooler than the air around them, condensation occurs. That makes a great environment for mold spores to attach to and grow. Those conditions are more prone to show up in bathrooms, kitchens, basements - where condensation and water are likely to be present. So the question I get is: does homeowners insurance cover mold? The temperatures are cooling down, and fall has finally arrived.

Did you know there are certain types of insurance claims that are more prevalent during the fall and early winter seasons? Here are the top ones: Yes, anti-theft devices are a smart investment for both your vehicle's safety and potential insurance savings.

Insurance companies acknowledge that these devices significantly lower the chances of a stolen vehicle, which can translate to discounts for policyholders. What are the major types of devices and the discounts they can lead to? Gun deer hunting season is starting soon in Georgia and South Carolina, and that means deer will be on the move.

It's not surprising that both states are considered a high risk state for animal collisions. Reports reveal GA drivers have a 1 in 83 chance of having a collision with an animal, and SC drivers have a 1 in 71 chance. That animal is a deer in 67% of animal collisions. Are auto-deer collisions covered by your auto insurance? As the temperatures turn cooler and fall arrives, squirrels, mice, and other rodents start looking for warm places to bunk up.

Unfortunately, attic spaces are great at matching their criteria, and these little rodents only need a very small space to get into your attic or crawlspace. Once inside, squirrels and mice can eat through wood, wiring, and insulation, which can create safety hazards. Homeowners insurance usually doesn't cover damage from squirrels and other rodents because it is considered preventable. What can you do to prevent this kind of damage? |

AuthorDennis Lam Archives

July 2024

Categories

All

|

RSS Feed

RSS Feed