|

Flash floods have already struck the CSRA this summer and caused unexpected property and vehicle damage.

Even though you may not live in a flood-prone area, there are plenty of low-lying and flood prone areas in the region where you may park your vehicle. Here's what you need to know about auto insurance coverage for flash floods: Basically, yes.

Although white cars get the greatest number of tickets, there are many more white cars on the road, so relatively speaking, the percentage of red car traffic tickets is highest. (Red cars also rank highest in accidents, by the way.) But is it due to law enforcement bias, driver behavior, or something else? Have you heard of "Operation Slow Down?"

Hopefully you have because it's currently under way in a number of southern states, including Georgia and South Carolina. Both highway patrol and local law enforcement agencies are looking out for drivers who are speeding or driving recklessly. Just for the record, do you know what would happen to your auto insurance premium if you did get ticketed for speeding? Here are 4 frequently asked questions (and answers) I get about speeding tickets: As insurance rates have climbed over the past several years, it has insureds hard pruning coverages to offset those increases.

It's understandable why they're doing that, but it's like gambling with their money. Many become significantly under-insured when they do that and take on huge financial risk. It takes just one event to financially destroy them, as the following examples illustrate: We're well into severe storm season and have already seen some storms cause damage in our area. Before the next storm blows through, there are things you can do quickly beforehand to minimize weather-related damage and prevent an insurance claim.

In addition to tips I've mentioned before, here are 3 more tasks you can do now: Whether you're moving across town or to a new state, one of the biggest decisions you'll need to make is how to transport your belongings.

The method you choose - hiring professional movers, renting a truck yourself, or using your own vehicle - can have a major impact on what insurance coverage you'll need. Here's a quick rundown: As insurers are tightening their criteria of their client portfolio due to the industry's hard market, the occurrences of cancellations and non-renewals are on the uptick.

It's especially important in this climate that you understand the difference between these two actions, reasons insurers take them, and how to avoid being the recipient of either of them. As with other industries, the insurance market is cyclical, and we're currently in what's called a "hard market."

A hard market is when political, societal, climate, and other factors cause insurers' profits to fall. Over the past several years, the impact of these factors have combined to a point where insurers have experienced greater losses and have had to make adjustments to maintain profitability. Insurers have become more conservative in what they are underwriting causing their portfolios to shrink and clients' premiums to rise. Historically, hard markets haven't lasted as long as "soft markets," which is when market conditions are just the opposite. In soft markets, insurers' revenue reserves are higher and they are able to be less strict in the risk they underwrite. This allows them to increase their client portfolios, there is more competition among companies, and premiums are very stable over time. SO, what can you do while we're in a hard market to soften its impact? In my last post, I highlighted the advantages of bundling your home and auto insurance policies. However, it's essential to recognize that bundling isn't always the best approach.

There are certain scenarios where keeping your home and auto insurance policies separate may prove more beneficial. Here are a few of these situations: Bundling your auto and home insurance policies with the same insurer can offer a range of advantages. Here are five compelling reasons to consider this approach:

Imagine this scenario: You're an employee of a company located far from its main office. You're on your way to a mandatory meeting at the main office, driving a rental vehicle provided for business purposes.

Suddenly, another driver runs a red light and crashes into your rental car, causing significant damage and injuring both you and the vehicle. In such a situation, determining whose insurance covers the damages and injuries can be complex. Here are 4 factors to consider: I continue to get calls from people because their auto insurance premiums are rising at renewal time, and they're searching for lower rates.

Many of these potential clients haven't had any accidents, tickets, moving violations, etc. to directly cause their rates to rise, so why are they experiencing this? There are a number of factors that contribute to this, including these 5 reasons: Renting a car for a spring road trip? When it comes to insurance coverage, things can get a bit tricky. Here are 4 items to consider before signing the rental agreement.

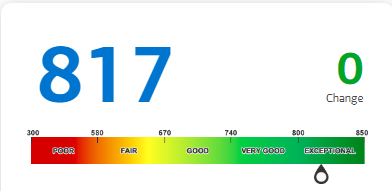

March is National Credit Education month so it's a great time to understand this.

Here are 2 ways your credit score influences your insurance rate: Check this out: a recent survey revealed that a staggering 65% of Americans are in the dark about the full extent of their home insurance coverage.

Even more surprising, 45% have faced the harsh reality of having their insurance claim denied due to insufficient coverage. That's why it's crucial to engage in regular conversations with your local independent insurance agent. This ensures that you not only recall your existing coverage but also assess whether any adjustments are needed. To guide your discussion, ask these 8 essential questions: Umbrella insurance serves as an added layer of protection, going beyond the confines of your existing insurance plans.

It acts as a safeguard against significant financial setbacks in situations where you may be deemed liable for damages or injuries to others including: bodily injury, property damage, personal liability, and advertising injury. Consider the following scenarios: Telematics is the use of GPS and other technology in vehicles to track driving behaviors and habits.

Insurance companies use behavioral analytics to determine the driving behavior of their policyholders and adjust insurance rates accordingly. There are pros and cons for policyholders considering using telematics. Here are a few: Historical data show that as people age, physical and cognitive changes may impact driving skills. Once you reach 70 years old, you can expect your auto premiums to rise. There are a number of things drivers at this age and older can do to lower their auto premiums. Here are 5 suggestions:

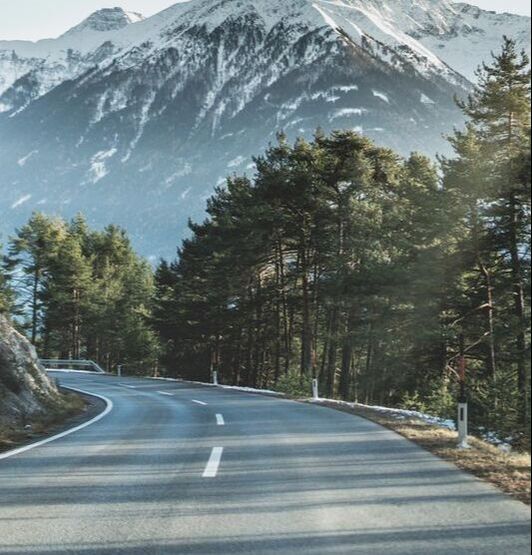

Of all the winter driving conditions, black ice is one of the most hazardous because you don't necessarily see it until you're on it.

What conditions most often create black ice, and how do you best navigate it? Do you know how to navigate driving in foggy conditions?

You frequently see safety tips for driving in sleet and snow, but one of the most dangerous conditions in the south this time of year is fog. You may unexpectedly run into thick fog conditions especially in early morning and later in the evening. How do you best navigate this condition? Just like with sleet and snow, it's best to stay off the road during these times but that's not always feasible. So, here are 3 safety tips when driving in foggy conditions: Are you planning a road trip this winter? If so, you need to be ready for wintery road conditions.

In addition to preparing your vehicle ahead of time for the cold temps, it's important to apply the following tips when navigating winter weather conditions once you're on the road: According to the Insurance Information Institute, nearly 13% of drivers countrywide are uninsured (12.9% in Georgia and 10.4% in South Carolina).

Many MORE drivers are UNDER-insured, meaning if they're found at fault in an accident, their policies aren't enough to cover accident-related losses. What recourse do you have if your car is hit and the person at fault doesn't have insurance? Did you know hit-and-run accidents - those in which someone causes an accident and then leaves the scene without providing their information - are more common than you might think?

And, Georgia ranks 4th according to Ride Safe Georgia for fatal hit-and-run accidents. So, if you're a victim of a hit-and-run does insurance cover the accident? What do you think has been the brand of car most pulled over by law enforcement this year for speeding?

Logically, a great guess would be a brand that makes a compact, sporty, high-end horsepower vehicle whose drivers tend to drive faster than the speed limit. According to a recent report by Insurify, According to AAA, 50% of vehicle crashes occur at night when far fewer autos are on the road.

This makes it critical that you pay attention to your headlight visibility as headlights that deteriorate over time can reduce light output by 80%! Most of the headlights used on vehicles are made of a type of plastic, which breaks down over time and causes clouding, fogging, and scratching. What can you do to ensure maximum headlight visibility and reduce your chances of being involved in an accident at night? |

AuthorDennis Lam Archives

July 2024

Categories

All

|

RSS Feed

RSS Feed