|

In today's online world, it's possible to get insurance quotes without the involvement of an agent. But, the convenience of direct access to insurance companies or chatbots may come at a cost when you find yourself in a claim situation. Going solo could lead to headaches and financial hardships if you haven't chosen the right coverage.

An experienced insurance agent is invaluable when it comes to providing personalized guidance for this critical form of financial protection. Rather than navigating the complex world of insurance alone, an agent partners with you to ensure your needs are met. When choosing an insurance expert to entrust with your coverage, consider these seven factors: Imagine this scenario: You're an employee of a company located far from its main office. You're on your way to a mandatory meeting at the main office, driving a rental vehicle provided for business purposes.

Suddenly, another driver runs a red light and crashes into your rental car, causing significant damage and injuring both you and the vehicle. In such a situation, determining whose insurance covers the damages and injuries can be complex. Here are 4 factors to consider: I continue to get calls from people because their auto insurance premiums are rising at renewal time, and they're searching for lower rates.

Many of these potential clients haven't had any accidents, tickets, moving violations, etc. to directly cause their rates to rise, so why are they experiencing this? There are a number of factors that contribute to this, including these 5 reasons: Renting a car for a spring road trip? When it comes to insurance coverage, things can get a bit tricky. Here are 4 items to consider before signing the rental agreement.

With St. Patrick's Day coming up, it's worth noting that even the Luck of the Irish can sometimes result in less-than-fortunate circumstances.

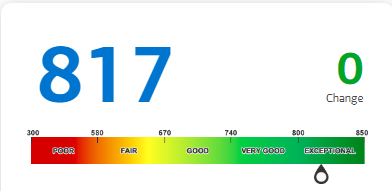

Here are a few unfortunate snippets from insurance claim reports to brighten your day: March is National Credit Education month so it's a great time to understand this.

Here are 2 ways your credit score influences your insurance rate: In the past, homeowners who rented out their properties once a year for local events often relied on their standard homeowners insurance.

But with the surge in short-term vacation rentals, insurance policies have also evolved, prompting the need for a closer look at coverage options, including these 5 areas: With tornado season already underway in the South, it's important to recognize what most standard homeowner's insurance policies provide for "all-perils" coverage.

This insurance coverage includes protection against tornado damage, but understand that there may be potential exclusions or limitations within your policy that can greatly impact your coverage. For example: Check this out: a recent survey revealed that a staggering 65% of Americans are in the dark about the full extent of their home insurance coverage.

Even more surprising, 45% have faced the harsh reality of having their insurance claim denied due to insufficient coverage. That's why it's crucial to engage in regular conversations with your local independent insurance agent. This ensures that you not only recall your existing coverage but also assess whether any adjustments are needed. To guide your discussion, ask these 8 essential questions: Homeowners insurance is a critical and required piece of home purchases if you're securing a mortgage loan.

A number insurance documents must be presented at the closing so it's important that you notify your insurance agent as soon as you have a contract. These include: "Green" discounts - perks on your homeowner's insurance for embracing energy efficiency and eco-friendliness - are becoming more popular among homeowners.

Along with familiar green discounts like solar panel and smart home technology, here are 3 additional possibilities you may not have thought about: Looking to save on homeowners insurance? You're probably familiar with some saving options like bundling and claims-free discounts, but there are other lesser-known discounts you might qualify for. Here are 3:

With Valentine's Day coming up soon, we can expect to exchange our expressions of love through cards, flowers, chocolate, and yes, engagement rings.

Valentine's Day is one of the most common days to get engaged, second only to Christmas Day. If you're planning to pop the question this Valentine's Day, have you thought about protecting your investment of that important piece of jewelry? Here's what you need to know about insuring an engagement ring: We've all experienced the increase in cost of goods and services over the past several years, so it's logical to anticipate that your insurance premiums might increase some, too. However, the amount of increased cost has taken some policy holders by surprise.

There isn't simply one major reason but a number of factors that have caused insurance premiums to rise. In addition to increasing rates, insurance carriers have also tightened requirements for insurance approval and/or renewal. Just like with increasing premiums, clusters of factors have made it more complicated to identify and predict risk. Technological advancements like machine learning and artificial intelligence have given insurers a more accurate way to predict risk by using huge volumes of data. So what kinds of data are now being used to modify (and tighten) criteria for insurance policy approval? Here are 3 lesser known factors you should be aware of that affect your perceived financial stability by insurers: When shopping for insurance, you've likely encountered a puzzling phenomenon: why do rates differ so drastically between insurance companies? It's a common question many find themselves asking as they navigate insurance options.

While it may not make sense on the surface, there are 7 valid reasons insurance rates can vary between companies: |

AuthorDennis Lam Archives

February 2024

Categories

All

|

RSS Feed

RSS Feed