|

You know the importance of insuring the big-ticket items in your home like jewelry, collectibles, firearms, and art, but what about other things that can add up too?

Here's a quick rundown of high-end household items that might slip your mind when it comes to insurance: Damage from hurricanes can include some or all of the following:

The coverage of standard homeowners policies can vary significantly, but in general: Insurers are tightening their standards and restrictions so before you call to file a homeowners insurance claim and have it denied, ask yourself these questions:

- Do you know specifically what your policy covers/excludes? - Was the damage from a sudden, acute circumstance or from a chronic issue over time? - Have you taken photos/videos to document the damage? - Have you spoken with your insurance agent to get his guidance on how you should proceed? It's very important you have this information BEFORE you contact your insurance company about the damage. Let's take an example: Numbers of reports indicate that:

· 66% (2 out of 3) of homes in the US are under-insured · 12/6% (1 in 8) motorists have NO insurance at all Why does this happen? In some cases, people can't afford that amount of insurance premium, opt for a lower amount, and take the risk of nothing happening to need it. BUT in many cases, people don't regularly review their policies. They fail to realize over time their policy coverage doesn't keep up with rising replacement costs and inflation. What are the consequences of being underinsured? Here are 3 examples: This is one of those endorsements to your homeowner's insurance that you may not think about until AFTER you need it.

This coverage covers all utility line damage that occurs on your property, including electrical, water, sewer, phone, and cable lines. These lines can be damaged by various factors like: According to the AAA Foundation, 11% of car accidents are hit-and-runs - more common than you might think.

If you're a victim of a hit-and-run does insurance cover the accident? If the person at fault is found, his liability insurance should take care of the damage and any deductible. If the person can't be located or is found but doesn't have insurance, coverage falls on your insurance policy. Your standard/liability-only auto policy doesn't cover these accidents. Several options you've hopefully already added to your policy might help: Fact or fiction: Car tires melt in extreme heat? .... If you said fiction, give yourself a star.

And what about this one: Very high temperatures can cause tire pressure to increase so much it can cause your tire to explode? .... That's a fact. While we're used to being continually hot in the South during the summer months, this year's unprecedented temperatures have brought new meaning to "hot." And that brings up potential situations you should be aware of regarding driving in extreme heat that you haven't really had reason to be concerned about in the past. Here are 7 must-know facts to help you remain safe while driving in this summer's sweltering sun: Have you ever heard of the term "subrogation" when investigating insurance but really don't understand it?

It's a legal term that is more commonly applied to auto insurance claims, and you need to understand what it is in case you ever need to use it. So buckle up and let's dive into: 1) what auto insurance subrogation is; 2) when you should consider using it; and 3) when you should NOT use it. Many insurance policy holders are getting a big surprise when they receive their upcoming renewal notices.

The news in a nutshell? Losses on the part of insurance companies are finally being seen in premium increases in renewal notices... AND as important, if not more so: insurance companies are also pulling out of certain states or disallowing new and policy renewal approvals. Why the sudden action on the part of carriers? Should you shop online for insurance?

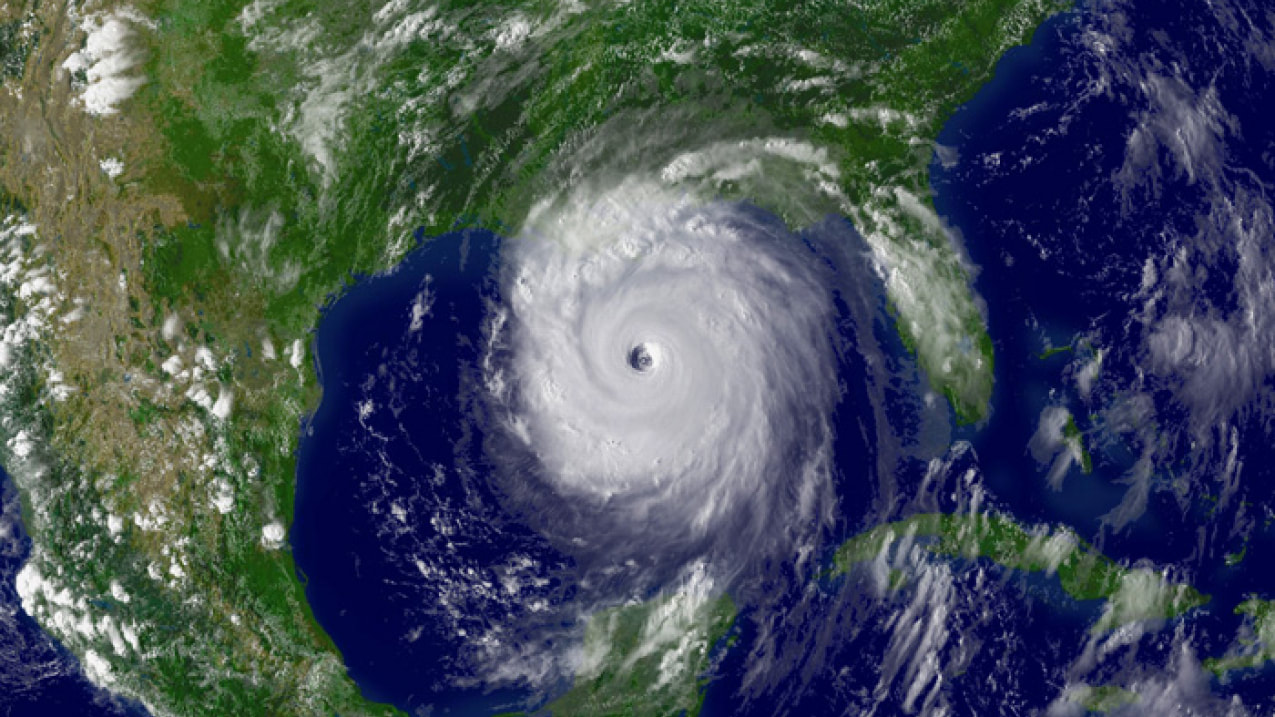

It's definitely fast and convenient, but it can cost you in the long run when it comes to insurance coverage. There is so much more to know today about insurance. As insurance carriers have expanded their options, so has the complication of decision-making. Choosing your own insurance online is risky because you don't know what you don't know. Floods, wild fires, tornadoes, hail, wind storms - all weather events that can wreak quick havoc and destruction to your home, vehicles, and other personal property.

Many times these weather events are unexpected and happen without much time to prepare. Instead of getting caught off guard, prepare for weather events before they happen. What do you need to do to be as prepared as possible? Here are several things to do that you may not have thought of that will be extremely helpful in these situations. It's that time of year when students head off to college. Does your homeowner's insurance cover your child's property while there?

If he is staying in a dorm or school-affiliated housing, generally speaking your coverage will extend to him but there may be restrictions. If he is staying off-campus in non-school housing, your coverage may likely not carry over. Other coverage requirements will vary among insurance carriers, with common examples being: |

AuthorDennis Lam Archives

February 2024

Categories

All

|

RSS Feed

RSS Feed