|

If you're taking to the road over the upcoming July 4th celebration period, drinking and driving can be one of the most expensive mistakes you can make.

When you get a DUI, do you know when it will show up on your insurance, how much to expect it to go up, and how long before it falls off your motor vehicle record (MVR)? Can you get a discount on your auto insurance for having an anti-theft device on your vehicle?

Because insurance companies recognize anti-theft devices reduce the incidence of stolen vehicle claims, they may give some discounts for them. Some states require insurers provide the discount if the devices are used. The amount of discount depends on the type of device. This can be confusing, but generally:

- all licensed drivers who live in the household must be included. - all non-resident licensed drivers who have access to the vehicles should be included. - if you have any unlicensed drivers with access to your vehicles, they must be disclosed. This can quickly become complicated, though, depending on whose name the vehicle is in vs. who's driving it vs. who has insurance on it. Yes and no.

It depends on the circumstance. So when is mold covered by your homeowners insurance policy? Usually mold in addition to mildew, fungus and spores will be covered if they result from what's called a "covered peril." Examples of covered peril s include: Your home is usually the most expensive investment you will ever make.

Unfortunately, reports show that 2 out of 3 homeowners are UNDERINSURED. That means they don't have enough coverage to replace their home if it is destroyed. There are numbers of reasons for being underinsured including the choices you select for your policy coverage. School's out and the summer RV travel season is well underway.

That means RVers will be making seasonal treks to the lake and beach to soak up some summer rays. If you're an RVer, you want to make sure you have the right insurance coverage so you can have peace of mind as you enjoy your excursions. This is especially since sudden unexpected summer storms can wreak havoc on an RV. An RV isn't simply a big vehicle so you need to think about its unique elements to make sure you adequately cover all of them. If you haven't looked over your RV policy recently, call me at 706-726-1446 to get an updated review and quote. Before you sign on the dotted line, make sure you understand what it will take to insure that structure.

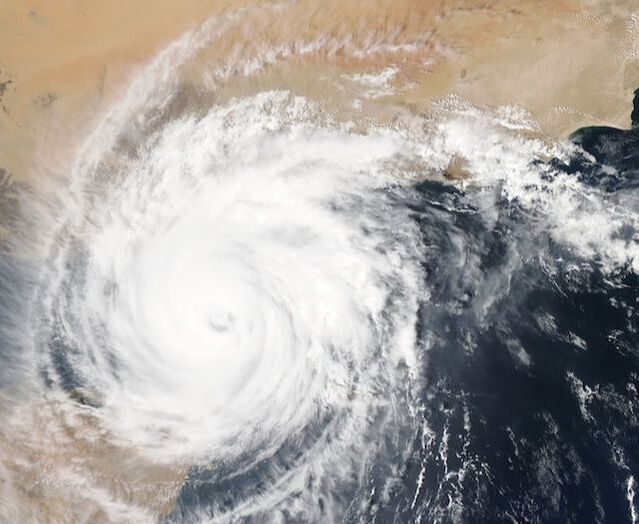

Here are a few red flags to insurance companies nixing coverage: Are severe damage-producing storms headed your way?

Here are a few things you should do to prepare for any weather-related event that you may not think about doing until AFTER they happen: Did you know that insurance carriers have their own requirements for accepting driver's education coursework for awarding a discount on your auto insurance premium?

If you're looking for a driver's ed discount on your auto insurance, it's best to check with your independent insurance agent. He can review the requirements of your insurance carrier with you so you select a good match. Have young drivers and want to see which insurance carrier provides the best coverage and rates for your situation? Call me at 706-726-1446 for timely help! The summer travel season is underway, and it's important that you check your vehicle tires before leaving for a road trip.

Tire issues are a cause of hundreds of preventable automobile accidents and fatalities every year. Things to check and maintain include: When my neighbor's tree falls on my property, who pays for damage and tree removal?

This is a common question, but the answer depends on the circumstances. In general: Now that school is out for the summer and the temps are heating up, one of the main pastimes to enjoy is swimming. If you're a pool owner, you already know that having one increases your risk of filing an insurance claim because it's considered an "attractive nuisance."

Accidents can easily happen and can quickly turn tragic without anyone noticing. (Did you know drowning is the leading cause of unintentional death of children 1-4 years old?) Here are several tips you may not have thought about to minimize your risk; Scenario: You purchased a condominium in a multi-story building on the coast to use as a vacation home. As a result of a building inspection, the inspection team issued an immediate alert to vacate the entire building because they found significant structural issues. To cover the cost of needed repairs, the Homeowners Association (HOA) assessed each condo owner an additional $500/month on top of the existing $500 monthly HOA fee.

How does loss assessment insurance coverage apply to the scenario above? If you live in Georgia and South Carolina, there is a good possibility that you could experience damage from a hurricane-related event.

What insurance do you need to cover water and wind damage? Depending on exactly where you live, a good plan could include a combination of insurance policies. Here are some essential tips to take BEFORE a hurricane comes your way: |

AuthorDennis Lam Archives

July 2024

Categories

All

|

RSS Feed

RSS Feed