|

In today's online world, it's possible to get insurance quotes without the involvement of an agent. But, the convenience of direct access to insurance companies or chatbots may come at a cost when you find yourself in a claim situation. Going solo could lead to headaches and financial hardships if you haven't chosen the right coverage.

An experienced insurance agent is invaluable when it comes to providing personalized guidance for this critical form of financial protection. Rather than navigating the complex world of insurance alone, an agent partners with you to ensure your needs are met. When choosing an insurance expert to entrust with your coverage, consider these seven factors: I continue to get calls from people because their auto insurance premiums are rising at renewal time, and they're searching for lower rates.

Many of these potential clients haven't had any accidents, tickets, moving violations, etc. to directly cause their rates to rise, so why are they experiencing this? There are a number of factors that contribute to this, including these 5 reasons: March Madness is a captivating event as millions of college basketball fans across the country analyze the teams and create their own (hopefully winning) brackets.

As we all watch the games and cheer for our favorite teams, we can also learn valuable lessons about selecting homeowners and auto insurance. Here are 3 important takeaways from March Madness that can help you choose the right homeowners insurance coverage. With St. Patrick's Day coming up, it's worth noting that even the Luck of the Irish can sometimes result in less-than-fortunate circumstances.

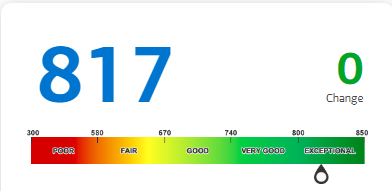

Here are a few unfortunate snippets from insurance claim reports to brighten your day: March is National Credit Education month so it's a great time to understand this.

Here are 2 ways your credit score influences your insurance rate: In the past, homeowners who rented out their properties once a year for local events often relied on their standard homeowners insurance.

But with the surge in short-term vacation rentals, insurance policies have also evolved, prompting the need for a closer look at coverage options, including these 5 areas: Homeowners insurance is a critical and required piece of home purchases if you're securing a mortgage loan.

A number insurance documents must be presented at the closing so it's important that you notify your insurance agent as soon as you have a contract. These include: Historical data show that as people age, physical and cognitive changes may impact driving skills. Once you reach 70 years old, you can expect your auto premiums to rise. There are a number of things drivers at this age and older can do to lower their auto premiums. Here are 5 suggestions:

When shopping for insurance, you've likely encountered a puzzling phenomenon: why do rates differ so drastically between insurance companies? It's a common question many find themselves asking as they navigate insurance options.

While it may not make sense on the surface, there are 7 valid reasons insurance rates can vary between companies: Winter brings its own set of challenges, and one crucial aspect is safeguarding your home from potential fires. According to the National Fire Protection Association, house fires occur more frequently in the winter than any other time of year.

Do you know the top causes of house fires? Read on to find out, including 5 valuable tips to prevent them: With 2023 wrapped up, remember to add "evaluate your insurance coverage" to your New Year's resolutions list. Why? Because changes you and your family experienced during 2023 or upcoming ones you expect this year will impact your insurance requirements.

Common examples include: As 2023 has wrapped up, it's time to re-evaluate your insurance plans. Why? Because changes you and your family experienced during 2023 or upcoming ones you expect this year will impact your insurance requirements.

Common examples include: Are you preparing for a New Year's Eve celebration? Make sure you take these 7 key tips to avoid any unforeseen insurance claims:

- This is obvious, but needs to be emphasized: if you or those you're with have too much to drink, do not drive. Either designate a driver ahead of time or tap local transportation resources to get to your destination. - If you're a host, have non-alcoholic beverage choices available, and stop serving alcohol several hours before the party is over. - Make sure your phone is charged, and be very aware of your surroundings if you're celebrating out in public. - Refrain from posting your location on social media so you don't alert potential thieves from visiting your residence while you're away. - If you plan to set off fireworks, observe local ordinances about them and ensure you do that in an open area. - Avoid setting off fireworks in a neighborhood to avoid conflict escalation regarding noise and property safety issues. - When you set off fireworks, make sure adults handling them take appropriate safety steps, and there is adequate supervision of children. Be proactive in safeguarding your assets. Make sure you have the coverage you need by reviewing your policies with an experienced independent insurance agent. Call me today: 706-726-1446. Wishing you an enjoyable and claim-free New Year's Eve! Are you concerned about package theft this holiday season? If so, you're not by yourself. Almost 7 out of 10 homeowners are, according to a recent survey by the Chamberlain Group.

Do you know if your renters or homeowners insurance covers package theft? Generally it does, but coverage is only helpful for purchases that are valued more than your deductible. Most deductibles fall between $500 - $2000, and over half of all packages stolen last year were worth $50 - $200, so filing a claim isn't a viable option or in your best interest. What do you do if your package isn't at your home when it says it was delivered? Throughout my career, I've had more clients than I'd like who declined certain insurance coverage only to then experience some tragedy in which that coverage would have provided much needed protection.

While you don't want to over insure your assets, you DO want to make sure your insurance is adequate. Insurance can be complex and confusing, so do yourself a favor and consult with a local experienced independent insurance agent. So you can avoid thinking: "I wish I'd ...." Don't gamble with your assets. Reach out to me for a comprehensive review to ensure you are adequately covered: 706-726-1446. If you're in an auto accident and you expect yours will be totaled, don't sit around and wait to hear from the adjuster. There are several things you need to do immediately:

Don't wait for disaster to strike. Get an experienced independent insurance agent in your corner now who can guide you expertly through situations like this: 706-726-1446. Do you "bundle" your insurance policies?

Generally, it's advantageous to do this, meaning you combine your insurance coverages with the same insurer. Companies reward you with discounts for using that one insurer to cover multiple policies. The most common combination is to use the same carrier for home and auto insurance. HOWEVER, there are exceptions, and this is another reason to use an experienced independent agent. Independent agents have access to numbers of insurance carriers, meaning they can mix companies to match your specific insurance needs. When would using different companies be better than bundling policies with one insurer? Here are a few examples: In a previous post, I explained why insurance has become so complicated. The key to eliminating these complexities is to engage the services of an experienced independent insurance agent. Here's why:

You're not by yourself if you feel overwhelmed when making decisions about your insurance coverage.

Why is insurance so complicated, and how do you navigate through coverage options to ensure you choose what's best for you? Read on for answers to these important questions. |

AuthorDennis Lam Archives

February 2024

Categories

All

|

RSS Feed

RSS Feed