|

Flash floods have already struck the CSRA this summer and caused unexpected property and vehicle damage.

Even though you may not live in a flood-prone area, there are plenty of low-lying and flood prone areas in the region where you may park your vehicle. Here's what you need to know about auto insurance coverage for flash floods: Even though meteorologists' technology resources allow us to anticipate some upcoming severe weather events, others can crop up with little warning.

Since these events can leave behind significant damage and disruption, policyholders should be prepared well ahead of time for such occurrences to ensure your safety and protect your property. Here are 5 key tips to help you stay prepared for a potential claim from a weather-related event: Filing a homeowners insurance claim is a necessary step when disaster strikes, but many homeowners are concerned about the potential impact of a claim on their insurance rates.

Does your insurance premium go up after filing a claim? Here's the answer, along with some clarification: We're well into severe storm season and have already seen some storms cause damage in our area. Before the next storm blows through, there are things you can do quickly beforehand to minimize weather-related damage and prevent an insurance claim.

In addition to tips I've mentioned before, here are 3 more tasks you can do now: Have you noticed the severe thunderstorms including hundreds of lightning strikes that have swept across large swaths of our country over the past several weeks?

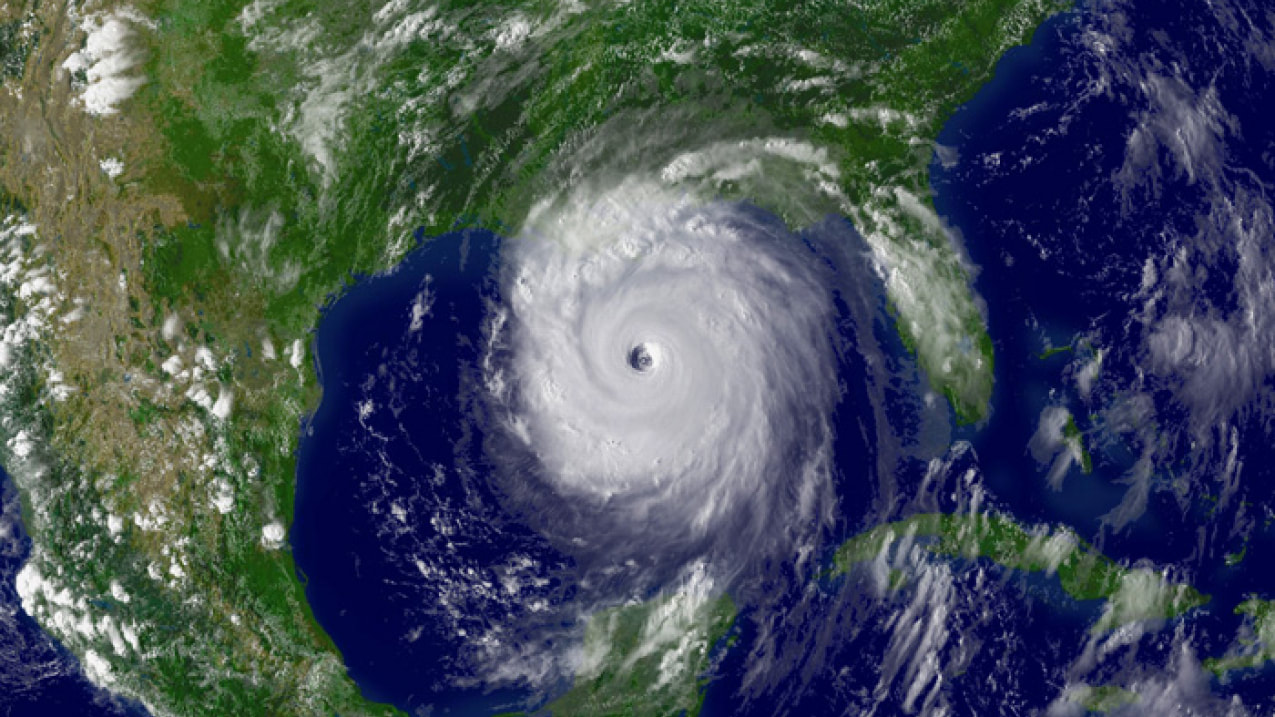

Lightning is among the most prevalent natural hazards capable of inflicting damage upon residential properties. It's important to understand what aspects of lightning-related harm are covered by your homeowners insurance policy, what falls outside its scope, and the necessary steps to take should your home sustain a direct strike. Damage from hurricanes can include some or all of the following:

The coverage of standard homeowners policies can vary significantly, but in general: Many insurance policy holders are getting a big surprise when they receive their upcoming renewal notices.

The news in a nutshell? Losses on the part of insurance companies are finally being seen in premium increases in renewal notices... AND as important, if not more so: insurance companies are also pulling out of certain states or disallowing new and policy renewal approvals. Why the sudden action on the part of carriers? Are severe damage-producing storms headed your way?

Here are a few things you should do to prepare for any weather-related event that you may not think about doing until AFTER they happen: Scenario: A severe wind and rain storm caused your home to flood. Will your homeowner's insurance cover the water damage?

There is plenty of attention given to steps to take before an anticipated storm to reduce the potential for damage and the need to file an insurance claim.

But, less focus is on steps to take AFTER a dangerous storm to reduce personal injury and property damage. A recent study after a tornado in Illinois confirmed that 50% of physical injuries were suffered after the storm when completing post-storm tasks. Any bad storm can damage power lines, electrical systems and gas lines that put may put you and your property at risk of fire, explosion, or electrocution. Here are 10 examples of steps to take after a bad storm: Storm season is underway and has already caused substantial damage over large areas of the south. There are things you can do ahead of time to minimize potential weather-related damage.

Here are 7 tips you can do quickly that can have a huge impact on minimizing weather-related damage and preventing the need to file insurance claims. Have you experienced unusually windy days in recent months? The wind combined with recent rainy days has created the potential for trees to uproot and fall, as happened at the Masters Golf Tournament.

Did you know in 19 states, a general homeowners insurance policy does NOT cover wind damage? Roof damage is one of the most common homeowners insurance claims. What is covered by your policy and what isn't?

Generally, it depends on the source of the damage. Most insurance companies provide coverage for sudden and unexpected occurrences like the following: Lightning is one of the most common natural disasters that can cause damage to homes, and it’s critical to know if your homeowners insurance policy covers this type of damage.

What is covered by homeowners insurance for lightning damage? Today's focus for Severe Weather Preparedness Week is on tornadoes. Do you know if homeowner's insurance covers tornado damage?

Most standard homeowner's insurance policies that include an "all-perils" coverage option typically cover damage caused by tornadoes. BUT, there may be specific exclusions or limits in a homeowner's policy that could impact the amount of coverage available for tornado damage. For example: It's severe weather preparedness week! Here are 7 important tips for policyholders to prepare for severe weather:

After a disaster, homeowners are in need of urgent repairs but this is also a time when unscrupulous contractors show up.

Generally, avoid contractors who: |

AuthorDennis Lam Archives

July 2024

Categories

All

|

RSS Feed

RSS Feed